At $3.03, Starhub is 32% off its 2015 peak and at its multi-year lows.

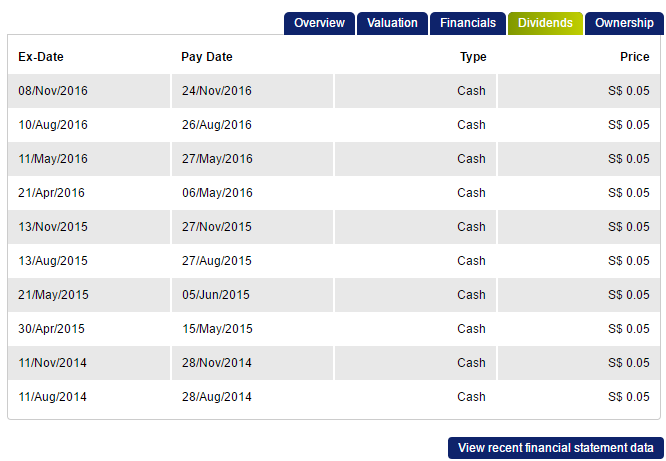

Dividend History

Starhub boasts of a stable dividend distribution history of $0.05 per quarter or $0.20 per year. At $3.03, this translates to a dividend yield of 6.6%. Regular distributions provide investors with cash flow relief.

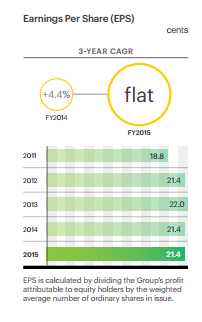

Earnings

Are the dividends sustainable? Starhub pays out a substantial portion of its earnings (more than 90% of its earnings). Earnings per share have been in the range of $0.21 per year. It is reasonable to assume that as long as Earnings per share stay above $0.20, investors should continue to enjoy $0.20 per share of dividend each year. In a mature telecommunications market such as Singapore’s where competition dynamics have stabilised over the years, earnings upside would be limited. Shareholders should not expect an improvement in dividend distributions. The question is whether earnings are sustainable.

TPG Telecom – The New Entrant

The conclusion of the spectrum auction marks the entrance of the 4th telco (TPG telecom) and a shift in the competition dynamics of the local telecommunications market, which is bound to erode the market share of the existing telcos and put a dent to their earnings. Talks for the introduction of a 4th telco have been out for awhile and the stock market reacted accordingly. Share prices of Singtel and M1 declined in varying extents depending on market perceptions of their earnings exposure to the local market soon to be disrupted.

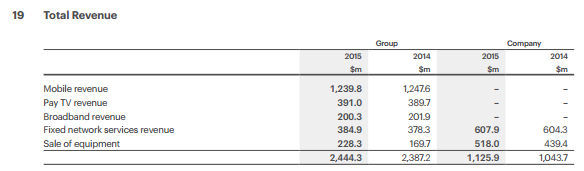

Starhub’s position

But TPG telecom is expected to offer only mobile services based on the spectrum awarded, which accounts for 50% of Starhub’s revenue based on 2015 AR. With bundling packages offering savings on other services like Broadband and Cable TV, TPG Telecom can expect Hubbers to have a tough time forgoing these savings for TPG mobile plans. Furthermore, any mobile plans offered by TPG will be met with a counter-response from existing telcos to defend their market shares such as the introduction of SIM-only plans – a strategy used by TPG in its dominant Australian market. M1’s earnings appears to be in a more vulnerable position in the writer’s opinion.

Has the market over-reacted to the introduction of the 4th telco? Is now a good time to pick up a blue-chip at its multi-year low to lock in a dividend yield of some 7%? Is the yield sustainable? Feel free to share your thoughts.

At 6.6% I could buy some other counters like Reits which may give more stable income with lesser disruption if we assume Interests Rates could be managed or applied to both. Also we could choose Singtel to mitigate. That's my thought.

ReplyDeleteThere are a few reasons I avoid REITs:

Deletea. Rental-support: REIT sponsors can provide rental support to the underlying properties. Yields are inflated and allow REITs sponsors to sell properties to the REITs at inflated values since properties are sold to the REIT at multiples of income of the property. REIT holders pay for the over-valuation while sponsor enjoys the over-valuation. This is a common tactic among REITs and there are no disclosures on which REITs provide income support.

b. Management Fees: REIT managers' compensation are based on Asset Under Management (AUM), giving them an incentive to gear up and go on an acquisition spree at the expense of REIT holders. There is no incentive to sell the properties to realize gains on the properties (if any at all) as this would reduce their compensation

c. Rights issue: Since there is a limit on the gearing level on REITs as regulated by MAS, there is no way to continue with acquisitions once the debt ceiling is reached. The easiest way to do so is to conduct rights issue at the expense of shareholders.

d. Interest rates: In a rising interest rate environment, earnings and distributions are eroded by higher interests since REITs employ sizable gearing. Interest rate swaps can be costly.

Hence, what is perceived as stable may not be that stable after all. Especially not when some REITs conduct frequent rights issue, which often require shareholders to return more than they have earned from distributions for the reasons above.

You could choose Singtel but the dividend yield (4.5%) is not as attractive and magnitude of decline not as steep as compared to Starhub in my opinion. Singtel's price movement looks pretty unaffected by news of the 4th telco but we won't know if that would be the case for its underlying business when the time comes.

Thanks for sharing your thoughts. Would be glad to discuss further.