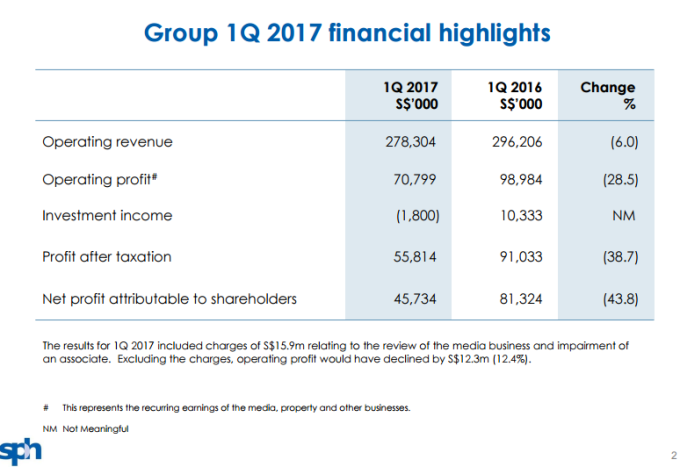

SPH released its 2017 Q1 results with earnings 43.8% lower than compared to the same period last year. The magnitude of decline should raise alarm on the future profitability and sustainability of its business.

- Net Profit Declined by 43.8% Q-o-Q

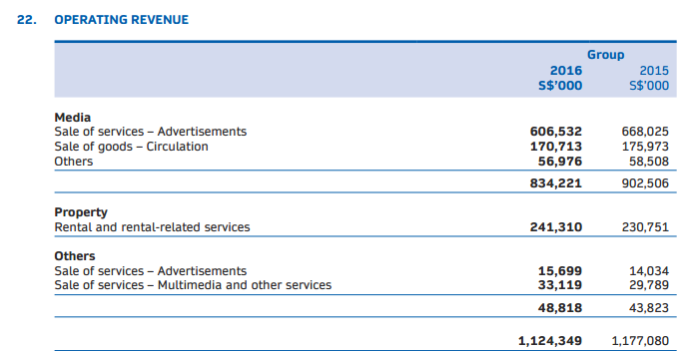

Core Business Revenue

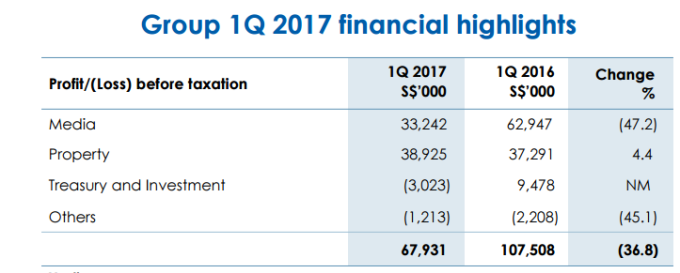

Excluding one-time charges related to the impairment and provisions of its investments, operating profit would have still declined by 12.4%. The decline in earnings is driven by a decline in the Media business segment which makes up 75% of total earnings based on 2015 AR.

- Decline in earnings mainly from Media Segment

- Media Segment makes up 75% of Total Revenue

Cause for concern?

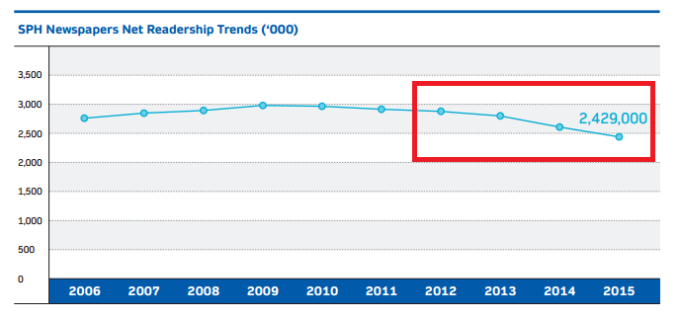

Disruptions in the traditional news media industry has been giving SPH a run on its money. SPH customers now can access news on a global level from multiple sources. Being the sole local news provider may have allowed SPH to defend the decline of the Media business. But for how long? Readership decline has accelerated in recent years which affects circulation and advertisement revenue.

- Readership decline has accelerated in recent years

Response to disruption - Investments

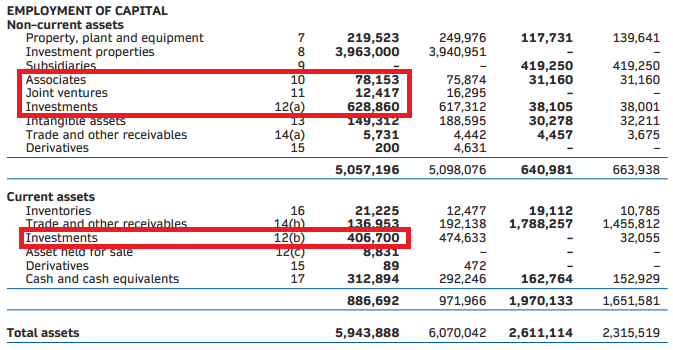

SPH is adapting to the disruptions. Significant investments have been made in digital businesses (e.g. STJobs, STCars.sg, ShareInvestor etc.) and startups to be part of that disruption. But competition in digital business is fierce with most burning cash, making losses and are not be viable until these businesses reach a sizable user base. And startups carry higher risks than most investments.

- More than $1 billion of assets (approx 20% of total assets) in Investments

Impairment issues

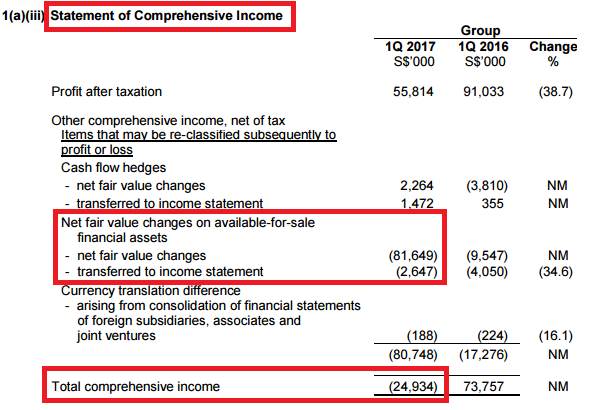

Most of the investments are in Available-for-sale Equity Securities which are not publicly traded and involve complex valuation techniques. Changes in its value are presented in a separate "Other Comprehensive Income" section not together with normal earnings, and is rarely discussed. This presents impairment risks and issues similar to the one-time impairment charge experienced this quarter. If we factor in fair value losses of these investments, SPH would be in a loss position. Which begs the question - are we only scratching the surface?

Silver Lining?

There is a silver lining though. Earnings from the Property Rental and Other segments are showing growth. However, these make up only 25% of Operating Revenue. Furthermore, investment in property to increase share of revenue for Property Rental is highly capital intensive and may not be a viable option - see assets balance sheet above.

Price Performance

SPH is 10% below its peak and at one of its multi-year low - perhaps a result of the threat to its core business - but is the decline over?

- SPH is 10% below its peak

Dividends Sustainability

The big question is - are the dividends sustainable?

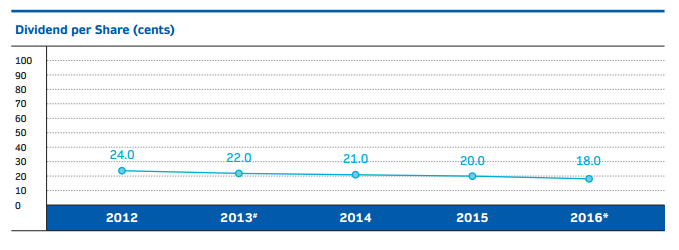

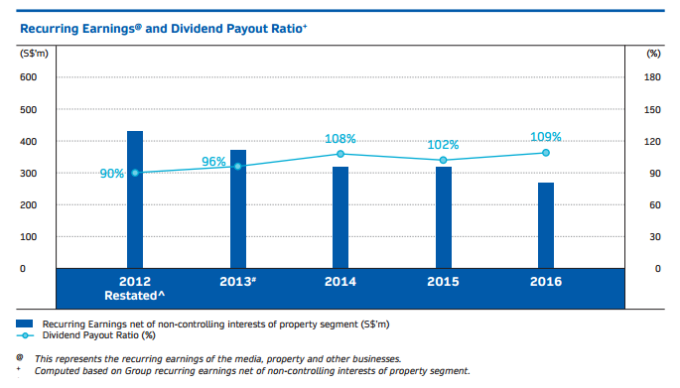

SPH has been a favorite among dividend players owing to its blue-chip status and sizable nominal dividend payments. In recent years, however, dividend payments have declined and the Company finds itself paying more dividends than it earns.

- Dividends have been declining over the L5Y

- SPH is increasingly paying out more than it earns

This writer feels that it may be time to re-evaluate one's position if you are pursuing a dividend strategy on this counter. What do you think?

Nice work friend.

ReplyDelete